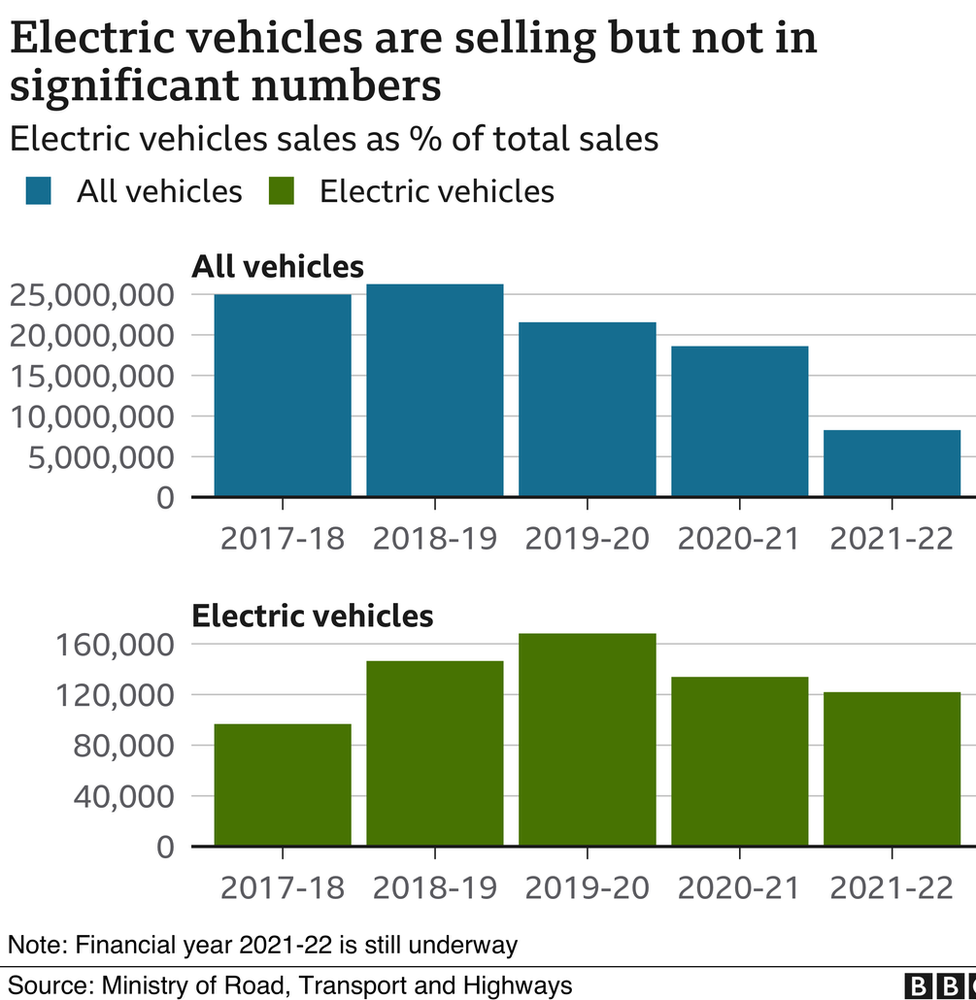

India sold more electric vehicles in September than any month previously. Sales have been rising since April - the start of this financial year - and are already nearing the previous year's total.

It's a glimmer of hope for an industry that has been struggling with a global shortage in semiconductor chips, coming on the heels of a period of sluggish growth.

But it's only a glimmer. Electric vehicle sales - 121,900 this financial year - account for only 1.66% of India's 20 million automobile sales, according to the Delhi-based think tank Council on Energy, Environment and Water (CEEW).

Some electric vehicle firms, especially makers of two-wheelers, are betting big, but the demand is lukewarm for cars and commercial vehicles like lorries. Prime Minister Narendra Modi's government is trying to change that with a $3.5bn (£2.5bn) scheme to boost manufacturing.

Electric vehicles will also cut emissions as pressure ratchets up for India, the world's third-largest carbon emitter, to set more ambitious climate goals ahead of the COP26 summit in November. The electric alternative is also growing in appeal as global oil prices surge, taking India's fuel import bill to a staggering $24.7bn.

"It's part-climate change and part-economics," said Gaggan Sidhu, the director of CEEW.

But is India ready for what is arguably the biggest shake-up in the auto industry since its birth more than a century ago?

The dream

"Consumers are saying, 'I want this', the government is pushing for it - the only thing remaining is for us to make electric vehicles," said Varun Dubey, the chief marketing officer of Ola Electric, a subsidiary of the eponymous ride-hailing app.

The firm recently announced a snazzy $320m scooter factory in India that plans to make 10 million electric two-wheelers every year - about 15% of the world's production.

"Nobody is debating whether we should move towards clean air. The question is how do we get there?," Mr Dubey said.

The Indian government is certainly in a hurry to get there. In 2017, India's Transport Minister Nitin Gadkari said he wanted only electric vehicles on Indian roads by the end of 2030 - an impossible target that he has since revised. Now, the plan is to have 30% of private cars, 70% of commercial vehicles, 40% of buses and 80% of two and three-wheelers go electric by 2030.

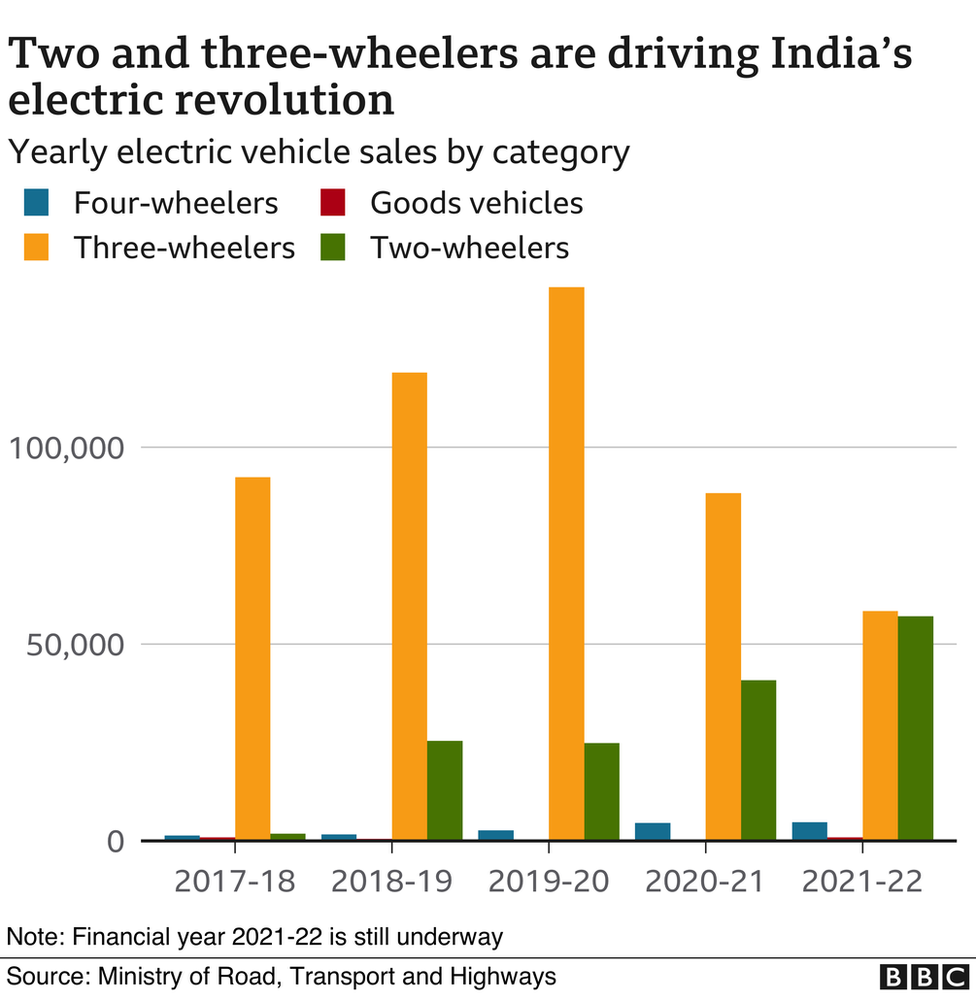

The good news is two and three-wheelers are well on their way to that target - electric alternatives already account for nearly half the sales in both categories this financial year, according to CEEW. And Hero Electric, India's biggest manufacturer of battery-powered scooters, has called for sales of gasoline-powered two-wheelers to stop by 2027.

"The world moves on two-wheelers. We are not going to move vehicles to electric unless we move two-wheelers," Mr Dubey said.

India sold about 17.4 million two-wheelers and just 2.7 million cars in 2019-20, according to the Society of Automobile Manufacturers. Two-wheelers also far outnumber cars in much of South and South-East Asia, and Africa - a vast future market for battery-powered motorcycles that Ola wants to capture.

The firm said it sold about 100,000 scooters to Indians during a two-day online purchase window last month. That's more electric two-wheelers than India has ever sold in a single financial year.

"Clearly there is pent-up demand," Mr Dubey said.

The reality

That appears to be less clear for electric cars, which account for less than 4% of India's car sales this financial year.

"You can only sell what's there," said Vinkesh Gulati, president of the Federation of Automobile Dealers Associations. He notes that the issue is to do with supply rather than demand.

He said the challenges range from too few charging stations (India has less than 2,000 compared to some 900,000 in China) to battery disposal to resale value (India has a massive second-hand market for cars).

And then there is the cost. The average price of a car in India is around 700,000 rupees - the cheapest electric car available starts at 1.2m rupees.

All of this leads to few options, Mr Gulati said, and even those disappear outside of the big metros - Delhi, Mumbai, Bangalore - which make up just a fifth of the market. "Ultimately, firms have to create a market for electric vehicles."

India's car buyers are fussy - aspirational but cautious with spending. It's why Maruti, India's biggest car maker, has made no move to launch an electric car, saying the prices are still too high. It's also why foreign brands have struggled to crack the market, and have even shut shop. Ford announced last month that it would stop making cars in India, even as it invested $11bn in electric vehicles in the US.

And yet Tesla is slated to enter the Indian market soon - it has complained of high import tariffs, and Mr Gadkari has said his government would provide "whatever support" was needed, but the firm should produce locally and not sell Indians Chinese-made cars.

More foreign firms may arrive when the Indian market for electric cars expands, said Puneet Gupta, the head auto sector analyst at IHS Markit. But he doesn't see that happening before 2030. Mr Gulati too is sceptical of any immediate surge in electric car sales unless the government introduces a "drastic policy".

For one, he said, uniformity would help given that different states in India offer different incentives - and some offer none.

But sales are rising. "We used to struggle for 300 [car] bookings, now we are getting 3,000 a day," said Shailesh Chandra, president of the passenger vehicles division at Tata Motors, India's biggest electric car maker.

"How consumers' mindsets shift will play a role in driving the market."

The firm just announced a $2bn investment in electric vehicles - this was after it raised $1bn from an Abu Dhabi holding company and TPG Rise, a San Francisco-based climate fund. It plans to spin off an electric vehicles business that would invest in new models (it wants to launch 10 of them by 2025), charging platforms and battery technology.

The future

"The electric vehicle world is quite different," Mr Gupta said. "The entire ecosystem has to collaborate."

The manufacturer builds the car, but a chemical company makes the batteries to run it and an energy supplier provides the power to charge it.

And they all have to be talking to each other to ensure continuous innovation, he added. "India is a tricky market for profitability. So, collaboration is essential to save costs and minimise losses."

Mr Dubey sees even bigger changes ahead: "All the data we have suggests people are more than willing to buy online," he said.

"Connected vehicles means you have more data on how they work and perform, improving transparency, insurance, loans, making them more efficient and affordable."

But as the so-called revolution grows, other challenges will crop up - India still relies on imported batteries, mostly from China, and that's a hurdle for an energy secure future. Mining for battery alternatives, such as aluminium, and disposal have environmental costs that could offset gains made elsewhere.

"Recycling is an issue, but the circular economy will be a business opportunity," said Mr Sidhu, of CEEW.

And the "mobility transition", he said, is already well underway in India.

"The energy transition crept up on us - we have no idea of the colour of the electron coming into our house. But this [electric vehicles] is manifesting all around us. Every 10th delivery guy is riding an electric scooter."

Charts by Shadab Nazmi

"electric" - Google News

October 25, 2021 at 07:02AM

https://ift.tt/2ZsbEfV

The bumpy road to India's electric car revolution - BBC News

"electric" - Google News

https://ift.tt/2yk35WT

https://ift.tt/2YsSbsy

Bagikan Berita Ini

0 Response to "The bumpy road to India's electric car revolution - BBC News"

Post a Comment