The age of the electric car is upon us. Earlier this year, the US automobile giant General Motors announced that it aims to stop selling petrol-powered and diesel models by 2035. Audi, based in Germany, plans to stop producing such vehicles by 2033. Many other automotive multinationals have issued similar road maps. Suddenly, major carmakers’ foot-dragging on electrifying their fleets is turning into a rush for the exit.

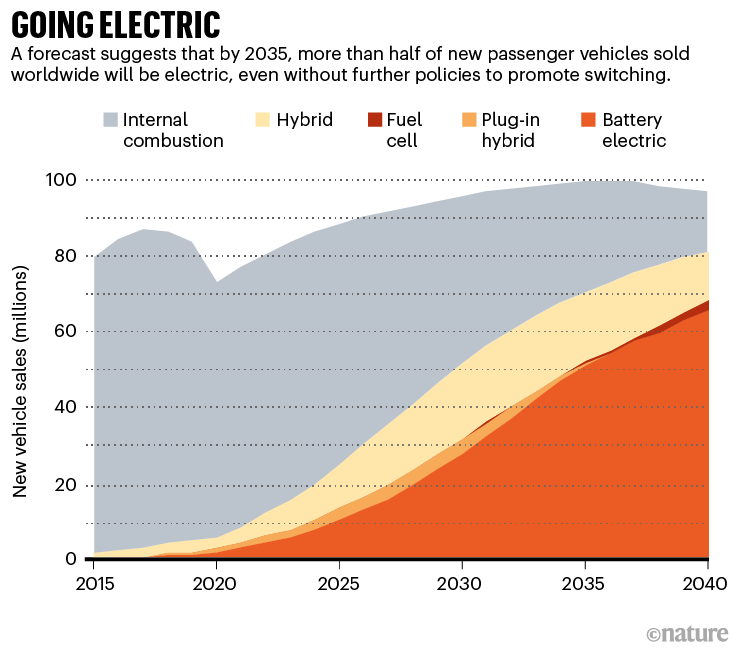

The electrification of personal mobility is picking up speed in a way that even its most ardent proponents might not have dreamt of just a few years ago. In many countries, government mandates will accelerate change. But even without new policies or regulations, half of global passenger-vehicle sales in 2035 will be electric, according to the BloombergNEF (BNEF) consultancy in London.

This massive industrial conversion marks a “shift from a fuel-intensive to a material-intensive energy system”, declared the International Energy Agency (IEA) in May1. In the coming decades, hundreds of millions of vehicles will hit the roads, carrying massive batteries inside them (see ‘Going electric’). And each of those batteries will contain tens of kilograms of materials that have yet to be mined.

Anticipating a world dominated by electric vehicles, materials scientists are working on two big challenges. One is how to cut down on the metals in batteries that are scarce, expensive, or problematic because their mining carries harsh environmental and social costs. Another is to improve battery recycling, so that the valuable metals in spent car batteries can be efficiently reused. “Recycling will play a key role in the mix,” says Kwasi Ampofo, a mining engineer who is the lead analyst on metals and mining at BNEF.

Battery- and carmakers are already spending billions of dollars on reducing the costs of manufacturing and recycling electric-vehicle (EV) batteries — spurred in part by government incentives and the expectation of forthcoming regulations. National research funders have also founded centres to study better ways to make and recycle batteries. Because it is still less expensive, in most instances, to mine metals than to recycle them, a key goal is to develop processes to recover valuable metals cheaply enough to compete with freshly mined ones. “The biggest talker is money,” says Jeffrey Spangenberger, a chemical engineer at Argonne National Laboratory in Lemont, Illinois, who manages a US federally funded lithium-ion battery-recycling initiative, called ReCell.

Lithium future

The first challenge for researchers is to reduce the amounts of metals that need to be mined for EV batteries. Amounts vary depending on the battery type and model of vehicle, but a single car lithium-ion battery pack (of a type known as NMC532) could contain around 8 kg of lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt, according to figures from Argonne National Laboratory.

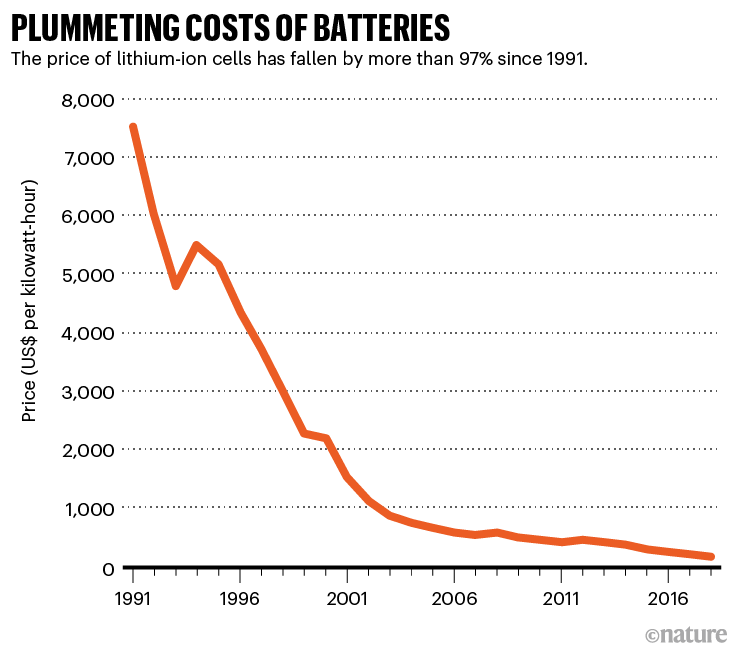

Analysts don’t anticipate a move away from lithium-ion batteries any time soon: their cost has plummeted so dramatically that they are likely to be the dominant technology for the foreseeable future. They are now 30 times cheaper than when they first entered the market as small, portable batteries in the early 1990s, even as their performance has improved. BNEF projects that the cost of a lithium-ion EV battery pack will fall below US$100 per kilowatt-hour by 2023, or roughly 20% lower than today (see ‘Plummeting costs of batteries’). As a result, electric cars — which are still more expensive than conventional ones — should reach price parity by the mid-2020s. (By some estimates, electric cars are already cheaper than petrol vehicles over their lifetimes, thanks to being less expensive to power and maintain.)

To produce electricity, lithium-ion batteries shuttle lithium ions internally from one layer, called the anode, to another, the cathode. The two are separated by yet another layer, the electrolyte. Cathodes are the main limiting factor in battery performance — and they are where the most valuable metals lie.

The cathode of a typical lithium-ion battery cell is a thin layer of goo containing micro-scale crystals, which are often similar in structure to minerals that occur naturally in Earth’s crust or mantle, such as olivines or spinels. The crystals pair up negatively charged oxygen with positively charged lithium and various other metals — in most electric cars, a mix of nickel, manganese and cobalt. Recharging a battery rips lithium ions out of these oxide crystals and pulls the ions to a graphite-based anode where they are stored, sandwiched between layers of carbon atoms (see ‘Electric heart’).

Lithium itself is not scarce. A June report by BNEF2 estimated that the current reserves of the metal — 21 million tonnes, according to the US Geological Survey — are enough to carry the conversion to EVs through to the mid-century. And reserves are a malleable concept, because they represent the amount of a resource that can be economically extracted at current prices and given current technology and regulatory requirements. For most materials, if demand goes up, reserves eventually do, too.

As cars electrify, the challenge lies in scaling up lithium production to meet demand, Ampofo says. “It’s going to grow by about seven times between 2020 and 2030.”

This could result in temporary shortages and dramatic price swings, he says. But market hiccups will not change the picture in the long term. “As more processing capacity is built, these shortages are likely to work themselves out,” says Haresh Kamath, a specialist in energy storage at the Electric Power Research Institute in Palo Alto, California.

The increase in lithium mining carries its own environmental concerns: current forms of extraction require copious amounts of energy (for lithium extracted from rock) or water (for extraction from brines). But more-modern techniques that extract lithium from geothermal water, using geothermal energy to drive the process, are considered more benign. And despite this environmental toll, mining lithium will help to displace destructive fossil-fuel extraction.

Researchers are more worried about cobalt, which is the most valuable ingredient of current EV batteries. Two-thirds of global supply are mined in the Democratic Republic of the Congo. Human-rights activists have raised concerns over conditions there, in particular over child labour and harm to workers’ health; like other heavy metals, cobalt is toxic if not handled properly. Alternative sources could be exploited, such as the metal-rich ‘nodules’ found on the sea floor, but they present their own environmental hazards. And nickel, another major component of EV batteries, could also face shortages3.

Managing metals

To address the issues with raw materials, a number of laboratories have been experimenting with low-cobalt or cobalt-free cathodes. But cathode materials must be carefully designed so that their crystal structures don’t break up, even if more than half the lithium ions are removed during charging. And abandoning cobalt altogether often lowers a battery’s energy density, says materials scientist Arumugam Manthiram at the University of Texas in Austin, because it alters the cathode’s crystal structure and how tightly it can bind lithium.

Manthiram is among the researchers who have solved that problem — at least in the lab — by showing that cobalt can be eliminated from cathodes without compromising performance4. “The cobalt-free material we reported has the same crystal structure as lithium cobalt oxide, and therefore the same energy density,” or even better, says Manthiram. His team did this by fine-tuning the way in which cathodes are produced and adding small quantities of other metals — while retaining the cathode’s cobalt-oxide crystal structure. Manthiram says it should be straightforward to adopt this process in existing factories, and has founded a start-up firm called TexPower to try to bring it to market within the next two years. Other labs around the world are working on cobalt-free batteries: in particular, the pioneering EV maker Tesla, based in Palo Alto, California, has said it plans to eliminate the metal from its batteries in the next few years.

Sun Yang-Kook at Hanyang University in Seoul, South Korea, is another materials scientist who has achieved similar performance in cobalt-free cathodes. Sun says that some technical problems might remain in creating the new cathodes, because the process relies on refining nickel-rich ores, which can require expensive pure-oxygen atmospheres. But many researchers now consider the cobalt problem essentially solved. Manthiram and Sun “have shown that you can make really good materials without cobalt and [that] perform really well”, says Jeff Dahn, a chemist at Dalhousie University in Halifax, Canada.

Nickel, although not as expensive as cobalt, isn’t cheap, either. Researchers want to remove it as well. “We have addressed the cobalt scarcity, but because we’re scaling so rapidly, we are heading straight for a nickel problem,” says Gerbrand Ceder, a materials scientist at the Lawrence Berkeley National Laboratory in Berkeley, California. But removing both cobalt and nickel will require switching to radically different crystal structures for cathode materials.

One approach is to adopt materials called disordered rock salts. They get their name because of their cubic crystal structure, which is similar to that of sodium chloride, with oxygen playing the part of chlorine and a mix of heavy metals replacing the sodium. Over the past decade, Ceder’s team and other groups have shown that certain lithium-rich rock salts allow the lithium to easily slip in and out — a crucial property to enable repeated charging5. But, unlike conventional cathode materials, disordered rock salts do not require cobalt or nickel to remain stable during that process. In particular, they can be made with manganese, which is cheap and plentiful, Ceder says.

Recycle better

If batteries are to be made without cobalt, researchers will face an unintended consequence. The metal is the main factor that makes recycling batteries economical, because other materials, especially lithium, are currently cheaper to mine than to recycle.

In a typical recycling plant, batteries are first shredded, which turns cells into a powdered mixture of all the materials used. That mix is then broken down into its elemental constituents, either by liquefying it in a smelter (pyrometallurgy) or by dissolving it in acid (hydrometallurgy). Finally, metals are precipitated out of solution as salts.

Research efforts have focused on improving the process to make recycled lithium economically attractive. The vast majority of lithium-ion batteries are produced in China, Japan and South Korea; accordingly, recycling capabilities are growing fastest there. For example, Foshan-based Guangdong Brunp — a subsidiary of CATL, China’s largest maker of lithium-ion cells — can recycle 120,000 tonnes of batteries per year, according to a spokesperson. That’s the equivalent of what would be used in more than 200,000 cars, and the firm is able to recover most of the lithium, cobalt and nickel. Government policies are helping to encourage this: China already has financial and regulatory incentives for battery companies that source materials from recycling firms instead of importing freshly mined ones, says Hans Eric Melin, managing director of Circular Energy Storage, a consulting company in London.

The European Commission has proposed strict battery-recycling requirements which could be phased in from 2023 — although prospects for the bloc to develop a domestic recycling industry are uncertain6. The administration of US President Joe Biden, meanwhile, wants to spend billions of dollars to foster a domestic EV battery-manufacturing industry and support recycling, but hasn’t yet proposed regulations beyond existing legislation classing batteries as hazardous waste that must be safely disposed of. Some North American start-up firms say they can already recover the majority of a battery’s metals, including lithium, at costs that are competitive with those of mining them, although analysts say that, at this stage, the overall economics are only advantageous because of the cobalt.

A more radical approach is to reuse the cathode crystals, rather than break down their structure, as hydro- and pyrometallurgy do. ReCell, the US$15-million collaboration managed by Spangenberger, includes three national labs, three universities and numerous industry players. It is developing techniques that will enable recyclers to extract the cathode crystals and resell them. One crucial step, after the batteries have been shredded, is to separate the cathode materials from the rest using heat, chemicals or other methods. “The reason we’re so enthusiastic about retaining the crystal structure is that it took a lot of energy and know-how to put that together. That’s where a lot of the value is,” says Linda Gaines, a physical chemist at Argonne and the principal analyst for ReCell.

These reprocessing techniques work with a range of crystal structures and compositions, Gaines says. But if a recycling centre receives a waste stream that includes many types of battery, various types of cathode material will end up in the recycling cauldron. This could complicate efforts to separate out the different cathode-crystal types. Although processes developed by ReCell can easily separate nickel, manganese and cobalt from other kinds of cells, such as those that use lithium iron phosphate, for example, they will have a hard time separating two types that both contain cobalt and nickel, but in different proportions. For this and other reasons, it will be crucial for batteries to carry some kind of standardized barcode that tells recyclers what’s inside, Spangenberger says.

Another potential hurdle is that the chemistry of cathodes is constantly evolving. The cathodes that manufacturers will use 10–15 years from now — at the end of the life cycle of present-day cars — could very well be different from today’s. The most efficient way to get the materials out could be for the manufacturer to collect its own batteries at the end of the life cycle. And batteries should be designed from the ground up in a way that makes them easier to take apart, Gaines adds.

Materials scientist Andrew Abbott at the University of Leicester, UK, argues that recycling will be much more profitable if it skips the shredding stage and takes the cells apart directly. He and his collaborators have developed a technique for separating out cathode materials using ultrasound7. This works best in battery cells that are packed flat rather than rolled up (as common ‘cylindrical’ cells are), and, Abbott adds, can make recycled materials much cheaper than virgin mined metals. He is involved in a £14-million (US$19-million) UK government research scheme on battery sustainability, called ReLiB.

Crank up the volume

Whichever recycling processes become standard, scale will help. Although media reports tend to describe the coming deluge of spent batteries as a looming crisis, analysts see it as a big opportunity, says Melin. Once millions of large batteries begin to reach the end of their lives, economies of scale will kick in and make recycling more efficient — and the business case for it more attractive.

Analysts say the example of lead-acid batteries — the ones that start petrol-powered cars — gives reason for optimism. Because lead is toxic, those batteries are classified as hazardous waste and have to be disposed of safely. But an efficient industry has developed to recycle them instead, even though lead is cheap. “Over 98% of lead-acid batteries are recovered and recycled,” Kamath says. “The value of a lead-acid battery is even lower than a lithium-ion battery. But because of volume, it makes sense to recycle anyway,” Melin says.

It might take a while until the market for lithium-ion batteries reaches its full size, in part because these batteries have become exceptionally durable: present car batteries might last up to 20 years, Kamath says. In a typical electric car sold today, the battery pack will outlive the vehicle it was built into, says Melin.

That means that when old EVs are sent to scrap, the batteries are often neither thrown away nor recycled. Instead, they are taken out and reused for less-demanding applications, such as stationary energy storage or powering boats. After ten years of use, a car battery such as the Nissan Leaf’s, which originally held 50 kilowatt-hours, will have lost at most 20% of its capacity.

Another May report from the IEA, an organization noted for its historically cautious forecasts, included a road map8 to achieve global net-zero emissions by mid-century, which includes conversion to electric transport as a cornerstone. The confidence that this is achievable reflects a growing consensus among policymakers, researchers and manufacturers that challenges to electrifying cars are now entirely solvable — and that if we want to have any hope of keeping climate change to a manageable level, there is no time to lose.

But some researchers complain that electric vehicles seem to be held to an impossible standard in terms of the environmental impact of their batteries. “It would be unfortunate and counterproductive to discard a good solution by insisting on a perfect solution,” says Kamath. “That does not mean, of course, that we should not work aggressively on the battery disposal question.”

"electric" - Google News

August 17, 2021 at 05:05PM

https://ift.tt/3g68JOT

Electric cars and batteries: how will the world produce enough? - Nature.com

"electric" - Google News

https://ift.tt/2yk35WT

https://ift.tt/2YsSbsy

Bagikan Berita Ini

0 Response to "Electric cars and batteries: how will the world produce enough? - Nature.com"

Post a Comment