General Electric’s GE shares popped 5.3% at the close of business on Mar 9, as the company provided a bullish long-term view for its Aerospace segment at the annual investor conference. The stock rose 9.2% intraday on Mar 9, reaching its highest level since 2018.

GE’s Aerospace segment is growing on the back of a continued increase in commercial air-travel demand and higher spending in the defense market due to heightened global instability. For 2025, the company expects the segment’s revenues to increase in the low double digits to mid-teens. It expects a profit margin of 25% for the year and a free cash flow conversion of more than 100%.

For the long term, General Electric predicts mid-single to high-single-digit revenue growth for the Aerospace segment. It expects to continue margin expansion for the unit over the long term. Free cash is estimated to be in line with net income over the long term.

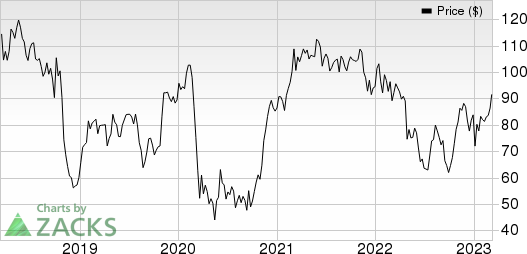

General Electric Company Price

General Electric Company price | General Electric Company Quote

For 2023, General Electric has reiterated its guidance for the Aerospace segment. It expects organic growth of mid-to-high teens in the year. Operating profit is anticipated to be between $5.3 billion and $5.7 billion. Free cash flow is expected to increase year over year in 2023 for the unit.

General Electric also expects long-term growth and improving margins across GE Vernova (combined operations of Power and Renewable Energy). After months of softness, Power segment demand rebounded in the fourth quarter of 2022, with onshore orders in North America more than doubling and higher aeroderivative unit shipments. However, the Renewable Energy segment remains weak due to lower US onshore wind volumes and continued pressure from onshore North American market dynamics. Revenues in the segment fell 17% year over year in 2022, with a 19% decline in orders.

For 2023, General Electric expects a loss of $200-$600 million for GE Vernova. Organic revenue growth is forecasted to be in the low-single-digit to mid-single-digit range for the ongoing year. It expects the division to be profitable in 2024 with a mid-single-digit profit margin. Over the long term, the company expects mid-single-digit revenue growth for the division and a high-single-digit profit margin. Free cash flow conversion is expected to be 90-110% over the long term.

As part of its portfolio reshaping actions, General Electric plans to split its business into three independent companies — GE Healthcare, GE Aviation, and GE Vernova — combining the operations of Renewable Energy and GE Power.

The healthcare business separation has already been completed in January. The separation of GE Vernova is expected to be completed in 2024, following which GE will operate as an aviation-focused company. The tax-free spin-offs are expected to strengthen each company’s operating performance and financial position.

2023 Guidance Reaffirmed

Despite persistent supply-chain headwinds and raw material cost inflation, General Electric has reiterated its 2023 guidance. The company expects high-single-digit organic revenue growth in the year. Adjusted earnings are expected to more than double to $1.60-$2.00 per share. Free cash flow is estimated to be $3.4-$4.2 billion in the year.

Zacks Rank & Key Picks

General Electric currently carries a Zacks Rank #5 (Strong Sell).

Here are some better-ranked stocks for your consideration:

Deere & Company DE currently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 4.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Deere has an estimated earnings growth rate of 30% for the current fiscal year. The stock has gained 13% in the past six months.

Ingersoll Rand IR presently carries a Zacks Rank #2 (Buy). The company delivered a four-quarter earnings surprise of 8.5%, on average.

Ingersoll Rand has an estimated earnings growth rate of approximately 3% for the current year. The stock has rallied approximately 13% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"electric" - Google News

March 10, 2023 at 10:25PM

https://ift.tt/9Wdpx8L

General Electric (GE) Shares Jump on Bullish Aerospace Outlook - Yahoo Finance

"electric" - Google News

https://ift.tt/eFCT6Ni

https://ift.tt/Mps4hEL

Bagikan Berita Ini

0 Response to "General Electric (GE) Shares Jump on Bullish Aerospace Outlook - Yahoo Finance"

Post a Comment